A Personal and Collective Financial Blueprint

Why Do We Struggle Despite Our Talent?

A good friend recently asked me a question that cuts to the heart of many of our financial realities:

“I just lost my loved-one, who was one of the family’s creative forces. I speak to another loved-one daily, who is a Grammy-nominated artist. I’m a multicultural professional whose work has appeared on TV and in magazines. Why are we all still struggling financially when far less talented individuals seem to prosper?”

This is a question that resonates deeply with many talented, hardworking people, especially those from communities historically denied access to wealth-building opportunities. It highlights two critical factors contributing to financial struggle: systemic barriers to funding and self-defeating financial habits shaped by cultural norms.

1. Access to Funding: The Systemic Barrier

One of the most significant challenges we face is limited access to funding. Many of us lack the financial networks, institutional support, or generational wealth that others take for granted. Loans are harder to secure, and when we do secure them, the terms are often unfavorable. Without capital, it’s difficult to scale talent into sustainable, long-term wealth.

2. Living Beyond Our Means: The Self-Inflicted Trap

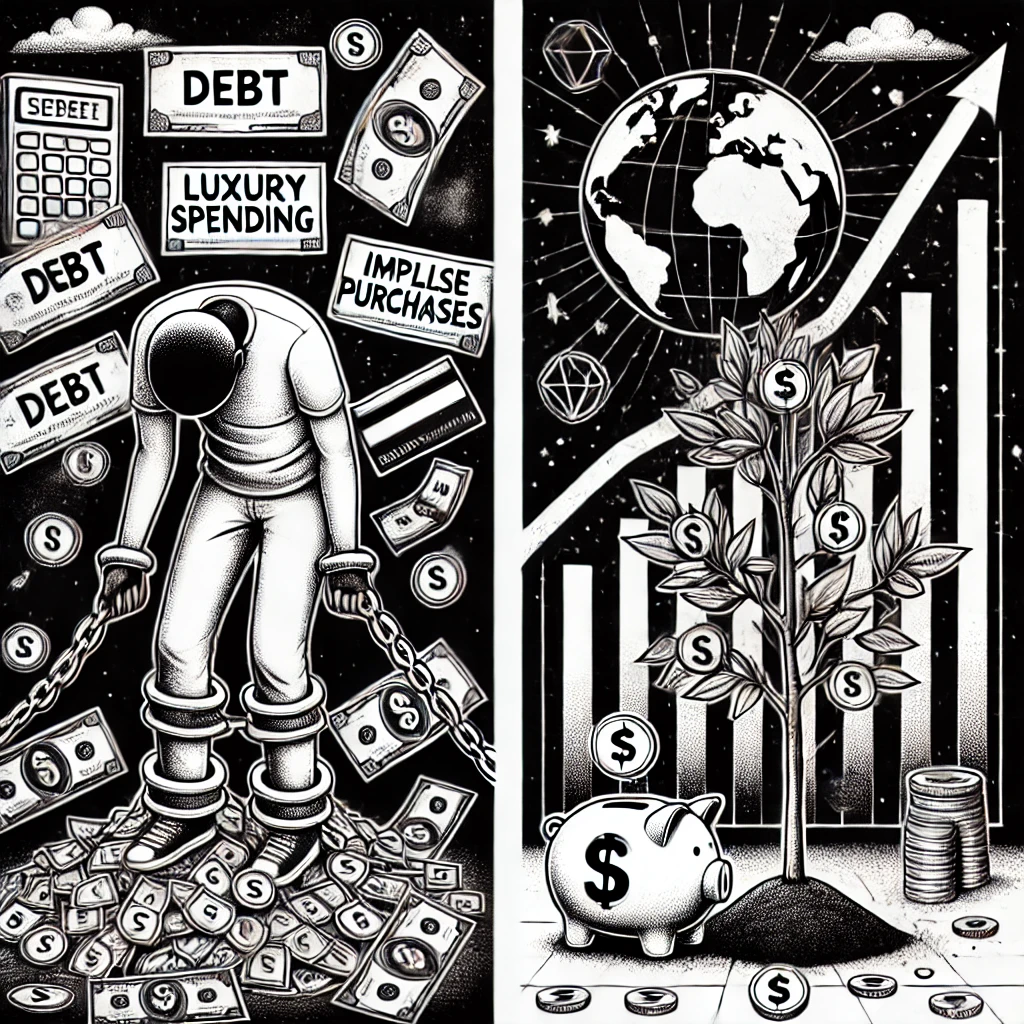

When we finally get a taste of financial success, it feels like a reward for years of struggle. But this sense of having “hit paydirt” often leads to living beyond our means. The reality is that what we think of as a windfall is often just seed capital. Until we are solidly in the black, every dollar we earn needs to be invested wisely, not spent lavishly.

The Million-Dollar Advance Cautionary Tale

Take the example of rappers and musicians. How many times have we seen an artist get a million-dollar advance and immediately splurge on chains, watches, luxury cars, and designer clothes? They mistake the advance for wealth, not realizing it’s a loan they have to repay through album sales. When those sales don’t cover the advance, they’re left in crippling debt instead of financial freedom. The chains may shine for a moment, but the debt shackles them for years.

3. A Personal Reflection: My $250,000 Advance

I’ve lived this experience myself. In 2004, I received a quarter-million-dollar advance for my publishing talents. At the time, it felt like I’d finally made it. But in hindsight, I now see how differently I could have handled that money.

Imagine if I’d taken $200,000 of that advance and invested it in an interest-bearing mutual fund. With a moderate return, that investment could have generated $2,000 to $5,000 per month in passive income—enough to provide me with financial stability for life. And the principal would have continued to compound exponentially over the years.

Fast forward to 2024. If I had made that choice 20 years ago, that initial investment would now be worth $900,000 to $1.3 million or more, depending on the rate of return. Instead of fleeting success, I would have built lasting financial freedom.

This isn’t just a personal regret; it’s a broader lesson for anyone who comes into unexpected financial gains. The money you receive today can either be a fleeting moment of wealth or a foundation for long-term prosperity. The choice is yours.

Below is 2 men who use free, raw materials to build a Temple Bamboo House An Underground Swimming Pool. Imagine the possibilities.

4. Cultural Defaults and Financial Priorities

Other cultures approach money with frugality and collective responsibility. Take the Muslim community, for example: modest clothing, conservative spending, and supporting extended family members are ingrained cultural practices. They understand the value of living below their means and building collective wealth.

In contrast, many of us define success through outward displays of wealth—brand names, luxury items, and an endless wardrobe. We buy clothes we haven’t worn in years while our bank accounts struggle to keep up. This mindset traps us in a cycle where every paycheck keeps us afloat but never ahead.

5. Breaking the Cycle: Practical Steps Toward Long-Term Success

Now that we recognize these challenges, the question becomes: How do we change? Here are some concrete steps:

- Treat Success as Seed Capital

Every dollar earned should first be invested back into your growth until you are financially secure. - Adopt a Frugal Mindset

Live slightly below your means. Redirect the difference into savings, investments, or future projects. - Focus on Passive Income

Invest in interest-bearing mutual funds, index funds, or other assets that generate regular income. - Leverage Compound Interest

Let your investments grow over time. Compounding interest can turn short-term gains into long-term wealth. - Create a Financial Plan

Develop a strategy that includes projections for growth, expenses, and potential downturns. Work with a financial advisor if needed.

The Lesson: Invest in Your Future

My experience serves as a reminder: Don’t let short-term gratification steal your long-term freedom. Windfalls and advances aren’t just rewards; they’re opportunities to build wealth. If we invest wisely and think strategically, we can break free from the cycle of struggle and create financial legacies that outlast us.